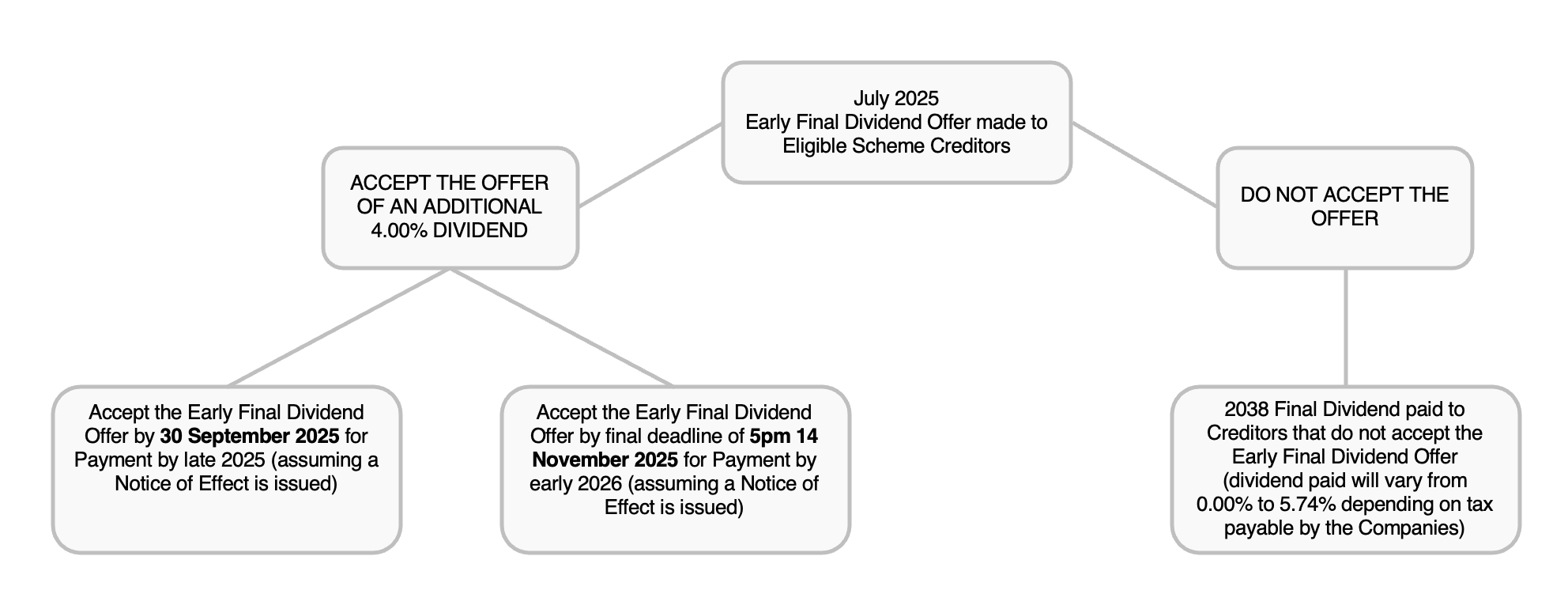

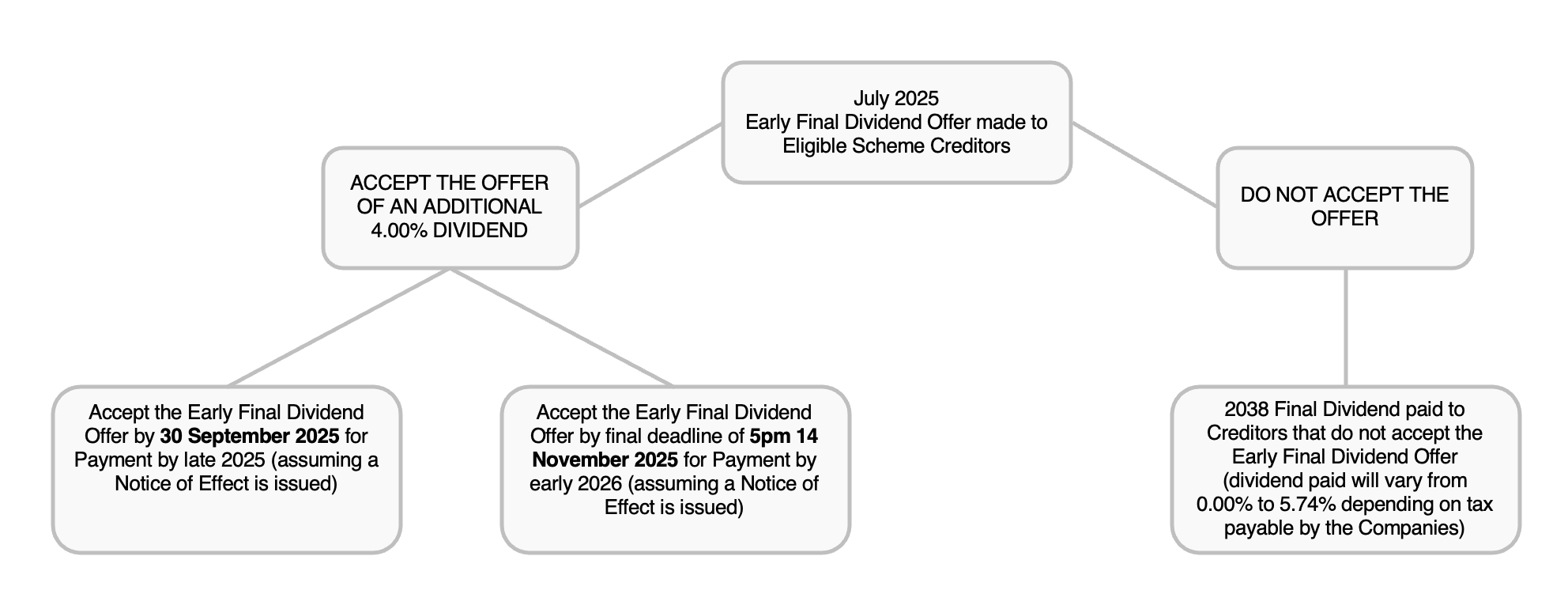

Background to the Early Final Dividend Offer

The Early Final Dividend Offer is a proposal being made to all Eligible Scheme Creditors to

receive a dividend in late 2025 or early 2026 in full and final settlement of their claims

against the Companies, rather than waiting until the Scheme terminates around 2038. The Early

Final Dividend Offer of 4.00% will increase the cumulative dividend to 80.00% providing

certainty on the level of dividend paid as well as distribution significantly earlier than

anticipated. If you do not accept the offer, the final dividend in 13 years' time will range

from 0.00% to 5.74% (depending on tax payable), with the maximum only achieved if no tax is

payable by the Companies at all.

HOW TO ACCEPT THE OFFER?

You must take action if you wish to accept the offer.

Please follow the below steps to review your specific Early Final Dividend Offer Schedule and

Agreement:

- Access the creditors’ Early Final Dividend portal here

- Create an account using the email address we have contacted you with

- Review your specific Early Final Dividend Offer Schedule

and Agreement and execute it before the deadline of 14 November 2025.

Creditors are strongly encouraged to complete the registration and acceptance process as early as

possible.

The final deadline for Scheme Creditors to accept the Early Final Dividend Offer

is no later than 5pm GMT on 14 November 2025

If you will not be able to obtain the required authorisation before the deadline of 14 November

2025 (for example, because you need Court approval) but wish to accept the Early Final Dividend

Offer in principle, please contact the Scheme Administrators at

[email protected].

FURTHER DETAILS OF THE FINAL DIVIDEND OFFER

- All Scheme Creditors with Net Liabilities under the Amending Scheme are entitled to

participate in the Early Final Dividend Offer.

- The final dividend of 4.00% will increase the cumulative dividend from 76.00% to 80.00%

- If you accept the offer, payment is expected late this year/ early 2026, subject to the

Scheme Administrators being satisfied with the overall response from creditors and issuing a

‘Notice of Effect’.

- If you do not accept the offer, you will receive your final dividend in 2038, which will be

equivalent to what you would have received had the Early Final Dividend Offer not been made.

In this scenario, the final dividend will range from 0.00% to 5.74% (depending on tax

payable), resulting in a cumulative dividend between 76.00% and 81.74%. The maximum final

dividend of 5.74% will only be achieved if no tax is payable by the Companies.

- The Early Final Dividend Offer does not apply to liabilities under Qualifying ILU

Policies.

WHY DOES THIS BENEFIT CREDITORS?

The Early Final Dividend Offer is a crucial part of a broader strategy by the Scheme

Administrators to accelerate the overall wind down of the Companies and distribution of

financial returns to Scheme Creditors.

If accepted, it will enable Scheme Creditors to receive their final dividend in 2025 or early

2026, which is significantly earlier and provides certainty of the level of dividend paid.

If the payment is made in 2038, the final amount paid will be uncertain as it is dependent on the

tax situation at the time.

SUPPORT FOR THE EARLY DIVIDEND OFFER

The Scheme Administrators have consulted key stakeholders in relation to the Early Final Dividend

Offer, including the Creditors’ Committee, which has a duty to act in the interests of all

Scheme Creditors. The Creditors’ Committee has undertaken an independent evaluation of the Offer

and is unanimously supportive.